(By Vic Hartman)

After a 25-year career with the Federal Bureau of Investigation (FBI) I have only recently returned to the private sector. As a private citizen with considerable public sector experience, I have read the previous posts on mortgage fraud with great interest, and accordingly, want to advance the discussion with some observations.

As was previously suggested, the decision to invest the limited investigative resources of the FBI is the result of various factors to include Congressionally controlled priorities implemented through funding restrictions, executive branch preferences, local United States Attorney’s priorities, and the American public’s demands through individuals and represented groups. As a further backdrop, then FBI Director Robert Mueller developed 10 priorities shortly after the events of 9/11 that continue until this day. The number one priority of the FBI is to protect the United States from terrorist attacks. The number eight priority is combatting white-collar crime which includes mortgage fraud.

But what meets the eye in terms of these stated priorities can be misleading. A priority generally means the FBI needs to recruit agents for specific subject matters, train the agents, and then place those agents in investigative positions associated with that priority. Further, the threats of a higher priority must take precedence and be addressed before dedicating resources to a lower priority. Despite terrorism being a higher priority than mortgage fraud, this never translated into mortgage fraud not being addressed. The reason is that in my opinion, the FBI has adequate resources to address both, and the United States has been blessed with not suffering a major terrorist attack since 9/11.

The previous posts noted that the FBI is easing its investigations of mortgage fraud as indicated in a report by the Justice Department’s Inspector General. In addition to the previous posts, I would add two additional reasons for the lowering of mortgage fraud within the FBI’s White-Collar Crime Program.

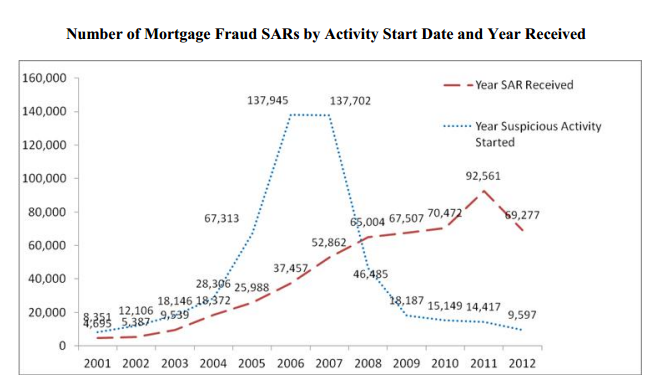

The first reason for lowering resources dedicated to mortgage fraud is this crime is occurring with dramatically less frequency (i.e., trending down). As required by federal regulations, banks must report all suspicions of mortgage fraud on Financial Crimes Enforcement Network (FinCEN) Form 111 titled Suspicious Activity Report (SAR). The results of this regulatory SAR filing process provides the FBI and bank regulators with amazingly accurate trending data for mortgage fraud. Unlike almost every other federal crime, SARs provide very timely information about the prevalence of mortgage fraud. In August 2013, FinCEN reported its latest data from 2012 as well as restating its previous trending analysis. See http://www.fincen.gov/news_room/nr/pdf/20130820.pdf.

The chart below is taken from this FinCEN report and very vividly shows a significant peak in mortgage fraud during the 2006-2007 timeframe:

As this spike was occurring, the FBI began rushing significant resources to this crime problem including the formation of regional task forces to combat the issue. In recent years, however, the FBI has moved some of these resources to higher priority matters.

This chart only depicts the filings of SARs by banks. Remember that a SAR means a bank found something suspicious. This often occurs when a mortgagor defaults and the underlying application and underwriting are found to be flawed upon subsequent review. The U.S. is currently in an escalating real estate market. Suspicious activity associated with mortgages is not coming to banks’ attention because default rates are down significantly. Although SAR reporting is down significantly, one cannot automatically assume mortgage fraud is down. This brings me to the second point.

Prosecutors play a major role in deciding the amount of resources the FBI dedicates to a crime problem. If a prosecutor will not take a case investigated by the FBI, it would be a waste of investigative resources for the FBI to continue to investigate that type of crime. Although not a legal impediment, a prosecutor will generally not prosecute a financial crime unless there is a loss to a victim. For example, say a borrower misstates her income on a loan application by saying she earned $250,000 a year when in fact she only earned $75,000 when applying for a $500,000 home loan. This borrower will eventually default on the loan due to the inability to pay. However, the bank is unlikely to suffer a loss because the home likely appreciated in value due to current market conditions. This brings me back to the prosecutor. A prosecutor will not be excited about bringing this case to trial for lack of jury appeal. Accordingly, this is another reason for the FBI lessening its focus on mortgage fraud.

I do think a big caution flag needs to go up here. The U.S. is well into another cycle of rising real estate values. If history tells us anything, we know there will be a down market (whatever goes up has a tendency to come down). You cannot tell if a swimmer is naked until the tide goes out. This will eventually occur, and the question will undoubtedly be asked again, “Why wasn’t the FBI investigating mortgage fraud?”